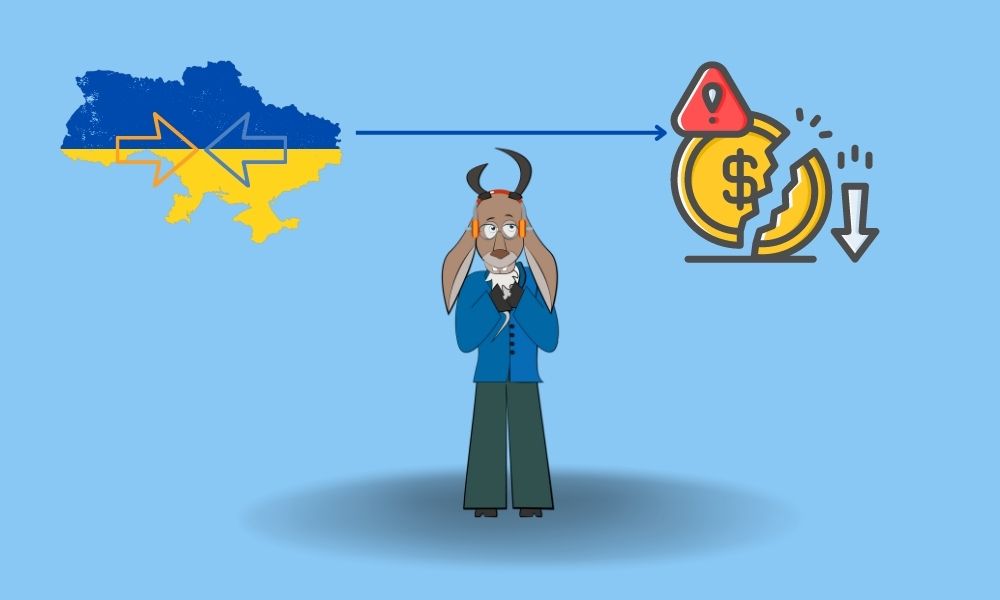

Since the Ukraine crisis, India's foreign exchange reserves have dropped by more than $80 billion. In the last week alone, the Reserve Bank of India sold more than $2 billion worth of dollars to keep the rupee from falling below 80 rupees per dollar.

The RBI's most recent weekly statistics showed that foreign exchange reserves dropped by $2.234 billion in the week ending September 9. They went from $553.105 billion the week before to $550.871 billion, which was the lowest level in almost two years.

Since Russia invaded Ukraine at the end of February, India's import cover has gone down for six weeks in a row and 23 out of 29 weeks. This is because the RBI has been constantly taking money from the reserves to fight a rise in the US currency caused by capital outflows into dollar-denominated assets.

The country's FX war chest is less than it was in October of last year, when it was at its highest point.

Even though there is a steady flow of foreign capital into the country's markets, the fall in the import cover has not been stopped because the current account deficit is getting worse.

This year, the rupee has gone from being worth about 74 dollars to being worth over 80 dollars, which is a record low. The RBI has had to step in to keep the currency from going through wild swings.

The RBI's latest monthly bulletin, which came out on Friday, showed that in July, the central bank sold a net of $19.05 billion on the spot foreign exchange market.

The way the rupee moved on the market shows that this trend kept going through August and into this month.

The country's foreign exchange reserves are likely to keep going down for a while, since the dollar is still rising against most major currencies to new highs not seen in over 20 years.

On Friday, the rupee had its worst week in five years as the dollar rose to a new record high on bigger bets that the Fed will raise interest rates and as the World Bank and the International Monetary Fund warned that rising inflation will slow economic growth.

A foreign exchange trader told Reuters that people on the market were worried that the rupee hadn't been allowed to drop below 80 dollars per rupee, and they saw that as a level to protect.

Indian stocks crashed in a market bloodbath on Friday, wiping out the week's gains and extending their losses for the third straight day. This was in line with a global sell-off caused by the broadest and most aggressive policy tightening in decades, which raised the risk of a recession.

That means that the RBI will have to take more money out of its reserves to protect the rupee from wild swings.

We expect the rupee to trade with a negative bias because the dollar is strong and people around the world are afraid of taking risks. "Research Analyst at Sharekhan by BNP Paribas, Anuj Choudhary, told PTI that global markets fell after IMF spokesman Gerry Rice raised concerns about a further slowdown in the global economy and said that some countries are expected to go into recession in 2023.

Even though the country's foreign exchange reserves have dropped a lot this year, it has still done better than other emerging markets, where import cover has dropped to crisis levels.

Based on the latest RBI data, India's foreign currency assets (FCA), which are the biggest part of the forex reserves, dropped by $2.519 billion to $489.598 billion in the week ending September 9. This was a smaller drop than the $6.527 billion drop to $492.117 billion in the week before the reporting period.

In dollar terms, the foreign currency assets include the value of the appreciation or depreciation of non-US currencies like the euro, pound, and yen held in foreign exchange reserves.

The value of the gold reserves, on the other hand, went up by $340 million to $38.644 billion.

During the reporting week, the Special Drawing Rights (SDRs) fell by $63 million to $17.719 billion, but the country's reserve position with the International Monetary Fund went up by $8 million to $4.91 billion.