In the face of the US dollar's upswing and UK political uncertainties, the GBP/USD lost its rebound momentum after reaching the highest level in three weeks at 1.1500. Following a turbulent prior week, cable ended the week moderately flat. In the midst of a holiday-shortened week, market investors are looking forward to the Fed minutes as well as the first-tier UK and US economic reports.

GBP/USD extended its previous week's reversal, as pound bulls gained extra support when UK PM Liz Truss and Kwasi Kwarteng indicated on Monday that the government will not go forward with a plan to repeal a 45% income tax rate. The UK government's tax policy reversal improved general market sentiment, allowing the safe-haven US dollar to prolong its decline from two-decade highs. Furthermore, weakening US PCE Price Inflation and ISM Manufacturing Prices Paid indicators, together with a steep decline in JOLTS Job Openings, impacted on aggressive Fed tightening bets, undermining sentiment surrounding the dollar and Treasury rates. Following the PMI report, the chance of a 75 basis point Fed rate rise in November fell to 50%.

Against this backdrop, the pair climbed further to touch the highest level in three weeks at the 1.1500 mark, but sellers quickly regained control as risk-aversion returned in full force on Wednesday amid growing geopolitical tensions between Russia and the West over the Ukraine crisis. According to Russia's ambassador to the US, the risk of a direct collision between Russia and the West has increased as a result of the White House's decision to deliver further military supplies to Ukraine. There were also reports that Russian President Vladimir Putin was planning to modify the status of the "special operation." The flight to safety atmosphere reignited demand for the safe-haven dollar, pushing GBP/USD below 1.1200 levels.

Furthermore, UK Prime Minister Truss' address at the Conservative Party Conference on Wednesday failed to enthuse GBP bulls. Truss asked the Conservative Party to unite in order to help rebuild the economy and the country, as investors remained concerned about the Kingdom's fiscal position in the aftermath of the previous week's catastrophic gilt sell-off. Following the mixed announcements of the US ADP employment and ISM Services PMI, as well as aggressive Fed comments, the dollar's corrective drop from multi-week highs accelerated on Thursday. The dip on Wall Street also boosted the greenback's recovery. Fed members maintained their hawkish stance that inflation is too high and that financial market volatility will not stop them from increasing interest rates.

Investors abstained from taking any directional bets on the major ahead of the all-important US Nonfarm Payrolls (NFP) data on Friday, extending risk-flows.

Nonfarm payrolls increased by 263,000 in September, above experts' expectations of 250,000, according to the US Bureau of Labor Statistics. Furthermore, the unemployment rate fell to 3.5% from 3.7% in August, while labor force participation fell to 62.3% from 62.4%. The immediate reaction to the positive employment news allowed the dollar to maintain its momentum ahead of the weekend, causing the GBP/USD to conclude the day in the red at about 1.1100.

The cable pair's decline is anticipated to continue in the next week, as investors seek protection in the dollar amid heightened global concerns. They will also be looking for statistics on the US Consumer Price Index (CPI) to assess the amount of the Fed's next rate rise.

Nonetheless, it's a holiday-shortened week, with American traders out on Monday for Columbus Day. Despite the fact that Fed Vice Chair Lael Brainard will be speaking at the National Association for Business Economics Annual Meeting in Chicago.

On Tuesday, the UK labor market data will be released, followed by remarks by Cleveland Fed President Loretta Mester and BOE Deputy Governor Jon Cunliffe. Andrew Bailey, Governor of the Bank of England, is expected to speak early Wednesday. The BOE statement will set the tone for the GBP/USD pair as the UK releases its monthly GDP and industrial figures. The minutes and remarks from the central bank's Financial Policy Committee (FPC) meeting will be released later in the day. However, traders' attention will be drawn to the publication of the US Producer Price Index (PPI) and the minutes of the Federal Reserve's September meeting, which will round up an interesting midweek trading day.

Although the reaction to the Fed minutes may be limited, as investors await the US inflation number on Thursday for new direction in the dollar, which may eventually influence cable. The US Jobless Claims will also be keenly monitored. The US inflation report will be key in determining whether the Fed will raise rates by 75 basis points in November. At the present, markets are pricing in a more than 80% chance of a large Fed rate rise next month.

Friday will be data-heavy as well, with the US Retail Sales gauge and Preliminary UoM Consumer Sentiment coming. Aside from macro data, impending geopolitical concerns between Russia and the UK will continue to play out.

Technical analysis of the GBP/USD

GBP/USD fell below the 20-day SMA on Thursday and closed below it for the second day in a row on Friday. Furthermore, the daily chart's Relative Strength Index (RSI) indicator fell below 50, suggesting a bearish bias in the near-term technical picture.

On the downside, important support is at 1.1050 (Fibonacci 23.6% retracement level of the most recent downtrend), followed by 1.1000 (psychological level) and 1.0900. (static level, psychological level).

If GBP/USD manages to break above 1.1240 (20-day SMA) and begins to use that level as support, it will most likely meet resistance at 1.1300 (Fibonacci 38.2% retracement). With a daily close above that level, further rises towards 1.1460 (Fibonacci 50% retracement) and 1.1500 (psychological level) are possible.

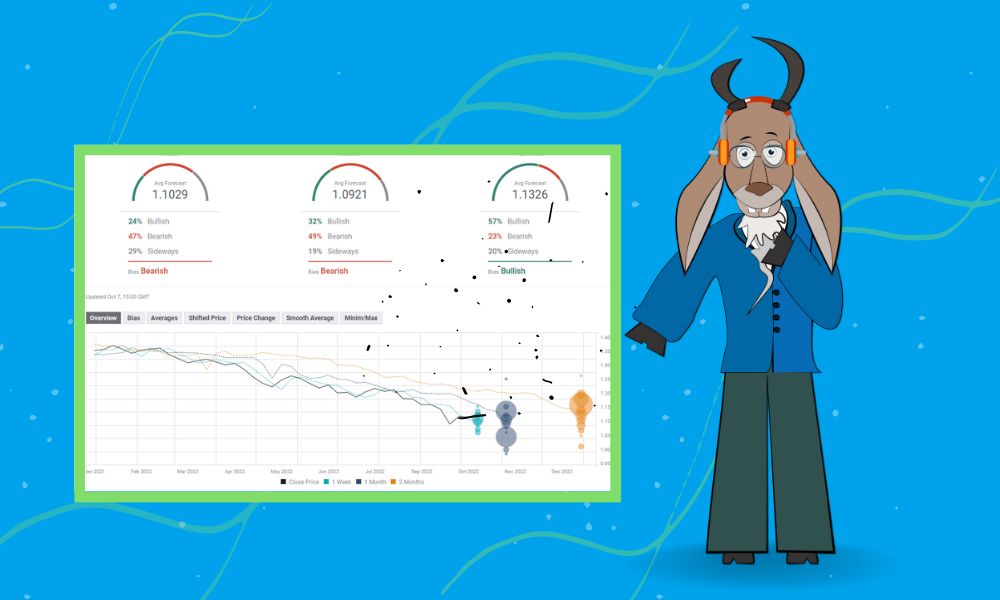

Forecast poll for GBP/USD

The near-term view for GBP/USD is bearish, with the one-week average goal of the FXStreet Forecast Poll being at 1.1030. The one-month perspective provides a mixed picture.

|

Hot Topic |

|

|